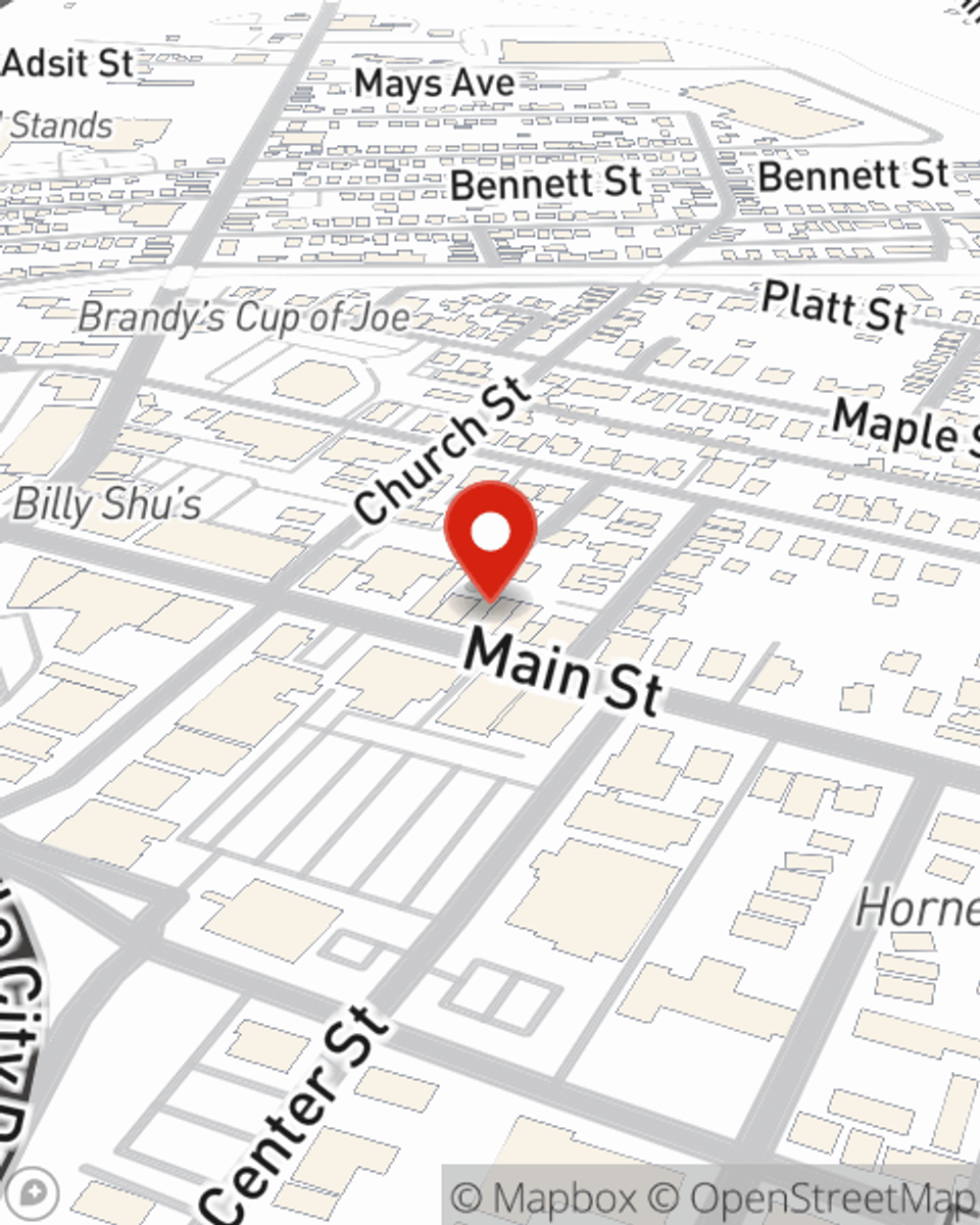

Business Insurance in and around Hornell

One of Hornell’s top choices for small business insurance.

No funny business here

State Farm Understands Small Businesses.

As a business owner, you have to think about all areas of business, all the time. The details can be overwhelming! You can save time by working with State Farm agent Dave Palma. Dave Palma understands where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your concerns and frees you to focus on growing your business into the future.

One of Hornell’s top choices for small business insurance.

No funny business here

Strictly Business With State Farm

State Farm has been helping small businesses grow since 1935. Business owners like you have relied upon State Farm for coverage from countless industries. It doesn't matter if you are a photographer or a dentist or you own a dance school or an acting school. Whatever your business, State Farm might help cover it with customizable policies that meet each owner's specific needs. It all starts with State Farm agent Dave Palma. Dave Palma is the agent who can relate to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to familiarize yourself about your small business insurance options

At State Farm agent Dave Palma's office, it's our business to help insure yours. Get in touch with our terrific team to get started today!

Simple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Dave Palma

State Farm® Insurance AgentSimple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.